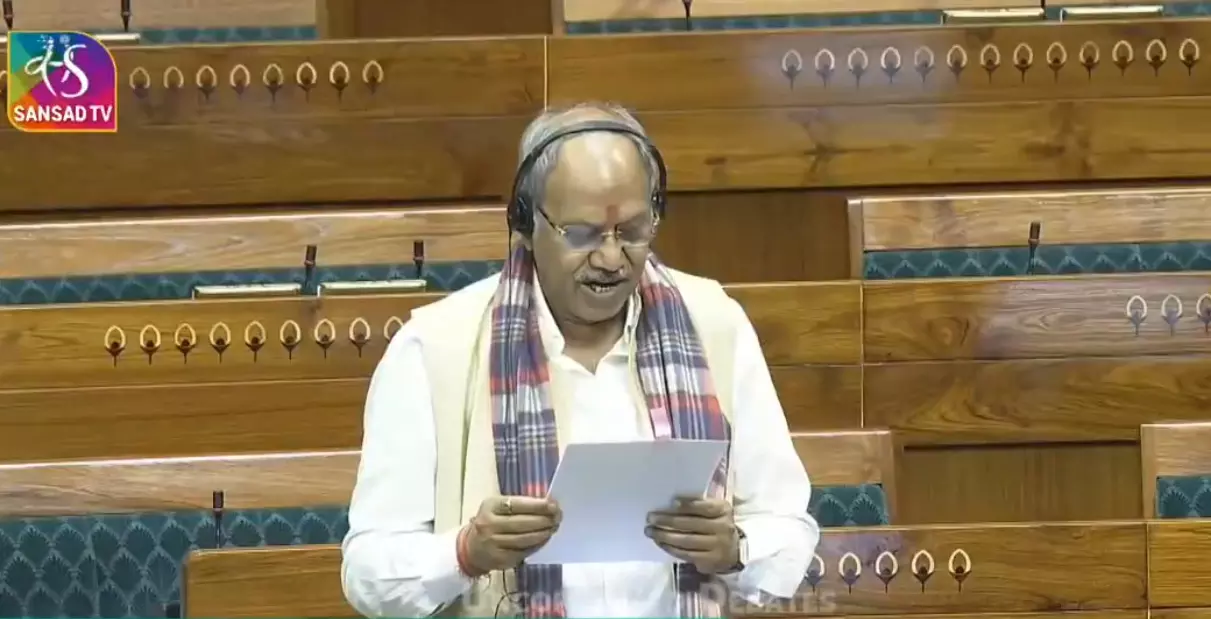

Raipur. MP Brijmohan Agrawal requested the Union Finance Minister to implement AI-enabled friction in banking. He said in the Lok Sabha that digital arrest is a huge challenge; according to the Supreme Court, victims in India alone, mostly elderly people, have lost ₹3,000 crore.

Between September 2024 and March 2025, one woman lost INR 32 crore. I have requested the Finance Minister to implement AI-enabled friction (cooling-off period – escrow) in banking to prevent such scams.

What did MP Brijmohan Agrawal say in the Lok Sabha?

I stand to raise a very serious financial matter that is eroding the financial security of our citizens, especially the elderly. We are seeing a dangerous surge in “digital arrest” fraud – a very sophisticated crime where perpetrators impersonate CBI or police officers through video calls. They keep victims under “digital surveillance” for days, psychologically coercing them with threats of false arrest and draining their entire life savings.

Also Read – Tyre repairman commits rape, unmarried woman gives birth to a child

In a recent incident, a victim lost almost ₹30 crore, her entire life’s earnings. These are not petty thefts; these are massive losses of capital and mental well-being that are happening right under the nose of our digital banking system. The core issue is the speed of transfers. Currently, under duress, a victim can transfer 80% or 90% of their life savings in a matter of minutes, and the banking system processes it as a legitimate transaction. This needs to change.

Banks in Singapore are now using “money lock” features and cooling-off periods for high-risk transactions. For example, if a transaction attempts to transfer an amount exceeding 50% of an account’s balance, the funds should be placed in a temporary escrow for a 12-24 hour “cooling-off” period.