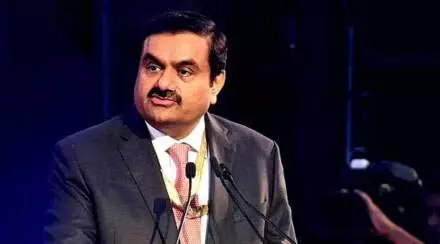

Business Business: GQG Partners, the promoter arm of the Adani Group, has increased its stake in Adani Group companies in the September quarter. According to Moneycontrol, promoters Adani Group invested Rs 12,780 crore and GQG Partners invested Rs 6,625 crore. The total investment of both the parties was more than Rs 19 billion.

Adani Group promoters have increased their stake in four listed companies. These four companies are Adani Energy Solutions Limited, Adani Enterprises Limited, Adani Group Energy Limited and Adani Power Limited. Meanwhile, the promoter group has reduced its stake in Ambuja Cement.

Shares of promoter Adani Green Energy Limited rose 3.42%. This proportion has increased from 57.52 per cent to 60.94 per cent since the September quarter. Hibiscus Trade and Investment bought 1.27% stake and Aadhar Investment Holding bought 1.69% stake at an average price of Rs 1,903. The investment was around Rs 10.31 billion, with promoters buying a 2.25% stake in Adani Power for Rs 5.73 billion. The promoter group invested Rs 427 million in Adani Energy Solutions and Rs 626 million in Adan Enterprises Ltd. Meanwhile, in September, the promoter group reduced its stake in Ambuja Cement from 70.33 per cent to 67.57 per cent, for which the promoter group received Rs 4,288.36 crore. Excluding the proceeds from this sale, the promoter Adani Group made an additional investment of Rs 12,778.71 crore in the September quarter.

GQG Partners, led by Rajiv Jain, invested Rs 6,625 crore in four Adani Group companies in the September quarter. These four companies are: Adani Enterprises Limited, Adani Energy Solutions Limited, Adani Green Energy Limited and Ambuja Cement.

GQG Partners invested Rs 3,390 crore in Adani Green Energy, Rs 1,784 crore in Adani Energy Solutions and Rs 1,077 crore in Ambuja Cement through QIP. The company also invested Rs 432 crore in Adani.