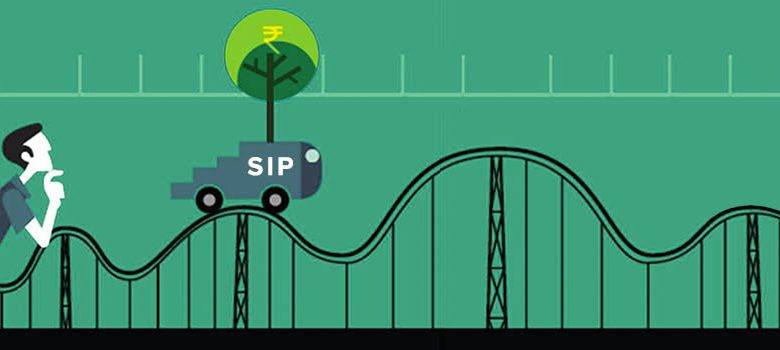

Stop SIP/use crash as an opportunity? What should be the market strategy?

Business: The stock market witnessed a sharp decline on Monday, reflecting a global sell-off due to concerns of a possible recession in the US and rising tensions in the Middle East. The main catalyst for this decline is a combination of global factors, including weak economic data and concerns of a possible US recession due to rising geopolitical tensions. Additionally, the yen carry trade has also contributed to the market’s downward slide. The benchmark Sensex and Nifty 50 indices declined by more than 3%, marking a significant reversal from the recent positive trend. Key factors contributing to the market decline: Weak US employment data has fuelled concerns about a possible economic slowdown, leading to risk-off sentiment among investors. Rising tensions in the Middle East have added to overall market uncertainty.

After the recent rally

some investors have booked profits, adding to the downward pressure on the market. But is Monday’s decline a short-term sell-off or should investors be worried and rethink their strategy? Despite the sharp correction, market experts believe the current downturn is likely to be temporary. Nifty50 and Sensex are expected to find support around 24,200-24,100 and 78,400 levels, respectively. Vishnu Kant Upadhyay, AVP, Research and Advisory at Master Capital Services Ltd, said, “Every dip in the market should be viewed as an opportunity to establish fresh long positions for the long term. Nifty50 has found major support in the 24,200-24,100 range and prices are unlikely to fall below this zone, while Sensex is expected to find support near the 55-day low