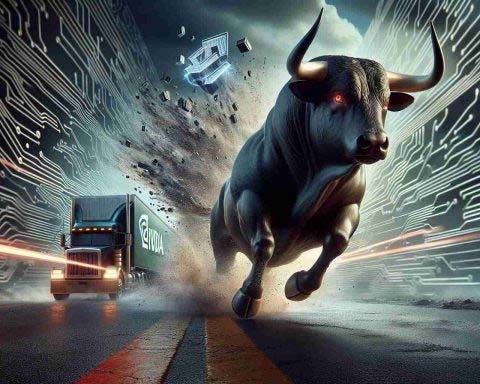

Is Nvidia’s bull run facing a major hurdle?

Technology: Nvidia (NVDA) is set to unveil its Q3 FY25 financial results on Nov. 20, with analysts forecasting a significant increase in earnings. Experts expect a dramatic increase in Nvidia’s performance, predicting earnings of $0.75 per share as well as revenue of $33.09 billion, reflecting staggering annual growth of 88% and 82.6%, respectively.

Despite the challenges it faces, Nvidia’s stock has seen extraordinary growth, climbing 182% last year and 187% so far this year. This rapid growth is underscored by its consistent pattern of exceeding financial expectations in eight of the last nine quarters, demonstrating the company’s strong market performance.

Forecasts for Nvidia’s future are largely optimistic. Many experts suggest the company is well-positioned to exploit the considerable opportunities in the evolving AI and data-center markets. This bullish sentiment has prompted analysts to maintain their buy ratings and raise price targets, emphasizing Nvidia’s long-term growth potential. Still, the company also has its critics. Some point to competitive pressures, potential regulatory hurdles due to antitrust investigations, and supply chain problems that could impact profit margins. According to options traders, Nvidia’s stock could experience significant volatility following its earnings report, with an expected move of 9.83% in either direction.