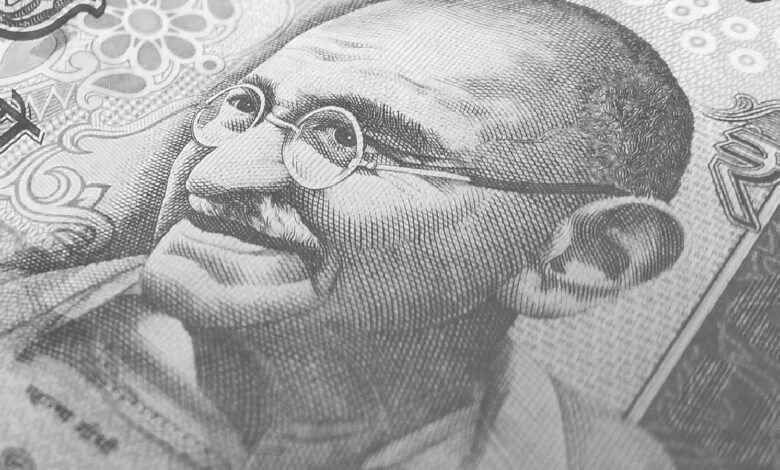

Gold prices once again reached an all-time high of Rs 83,800 per 10 grams

Delhi Delhi. Gold prices rose for the second consecutive session in the national capital on Thursday amid strong global trends and hit a new all-time high of Rs 83,800 per 10 grams. According to All India Sarafa Association, the yellow metal of 99.9 per cent purity rose by Rs 50 to a new high of Rs 83,800 per 10 grams, while its previous close price was Rs 83,750 per 10 grams on Wednesday. Gold of 99.5 per cent purity also rose by Rs 50 to hit an all-time high of Rs 83,400 per 10 grams. In the previous trading session, it closed at Rs 83,350 per 10 grams. Besides, silver also rose by Rs 1,150 to Rs 94,150 per kg, while its previous market close price was Rs 93,000 per kg. Meanwhile, gold contracts for February delivery in futures trade rose by Rs 575 or 0.72 per cent to Rs 80,855 per 10 gram. For April contracts, the yellow metal rose by Rs 541 or 0.67 per cent to a new peak of Rs 81,415 per 10 gram on the Multi Commodity Exchange (MCX).

“Gold traded positive on MCX as participants prepared themselves against a possible import duty hike after a 6 per cent cut in the last budget.

A significant difference was seen between Comex and MCX, with domestic gold gaining 2.5 per cent last week while Comex gained only 0.50 per cent,” said Jatin Trivedi, VP Research Analyst, Commodity & Currency, LKP Securities. Silver futures for March delivery rose Rs 1,050 or 1.14 per cent to Rs 92,916 per kg from its previous close of Rs 91,866 per kg on Wednesday.

In the international markets, Comex gold futures jumped $23.65 per ounce or 0.84 per cent to hit an all-time high of $2,817.15 per ounce.

Saumil Gandhi, Senior Analyst, Commodities at HDFC Securities, said, “Uncertainty about US President Donald Trump’s policy has led to a new high in US Treasury yields. “This leads to a decline, helping gold prices continue their northward journey.”Furthermore, investors are still concerned about the economic consequences of Trump’s trade tariffs and protectionist policies, which continue to support the safe-haven precious metal, Gandhi said.