Finance Minister O.P. Choudhary Outlines Robust Vision for GST Reforms: Calls for Strict Action Against Bogus Registrations and Fake Invoices

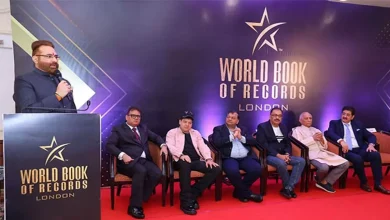

Raipur: A crucial meeting of the Group of Ministers (GoM), constituted to enhance transparency, technological integration and efficiency in Goods and Services Tax (GST) revenue collection across the country, was convened today New Delhi. Chhattisgarh’s Finance Minister, Mr. O.P. Choudhary, participated as a member of the GoM and presented a series of key recommendations aimed at curbing tax evasion, modernising registration systems, and preventing fraudulent input tax credit claims. The group is chaired by Goa Chief Minister Dr. Pramod P. Sawant.

Mr. Choudhary shared Chhattisgarh’s experiences and policy interventions, underscoring the urgent need to adopt technology-led solutions to address persistent challenges in GST administration. The discussions focused on analysing revenue trends, assessing economic factors influencing collections, and identifying coordinated strategies for sustainable growth.

During the deliberations, finance ministers from various states presented detailed insights into factors impacting GST revenues within their jurisdictions. Mr. Choudhary highlighted the proactive steps undertaken by Chhattisgarh to strengthen anti-evasion frameworks and improve compliance.

He emphasised that Chhattisgarh has leveraged advanced data analytics and artificial intelligence tools extensively to detect irregularities, facilitate compliance, and protect genuine taxpayers. Such measures, he said, have contributed significantly to enhancing the state’s GST collections.

Presentations were also made on cutting-edge platforms including BIFA, GST Prime, and the e-Way Bill portal. Mr. Choudhary advocated for the uniform adoption of these innovations nationwide to enable faster detection and action against fraudulent operators.

Highlighting specific issues, the Finance Minister called for the development of a centralised digital framework to enforce transparency in registrations, control fake invoices, and prevent bogus input tax credit. He noted that such initiatives not only boost revenue but also reinforce taxpayer confidence.

Mr. Choudhary underscored that under the leadership of Chief Minister Vishnu Deo Sai, Chhattisgarh has instituted regular reviews and data-driven decision-making processes, delivering consistently positive outcomes. He observed that the state’s model could serve as a benchmark for other regions aiming to strengthen GST administration.

He further called for collaborative efforts among all states to ensure stability and sustained growth in GST revenues. Expressing optimism, Mr. Choudhary said he was confident that the recommendations put forward by the GoM would soon be adopted by the GST Council.

The meeting is expected to play a pivotal role in formulating comprehensive reform proposals, creating a new course for tax administration and revenue mobilisation across India.