Bengalureans lose Rs 197 crore to stock fraud in four months

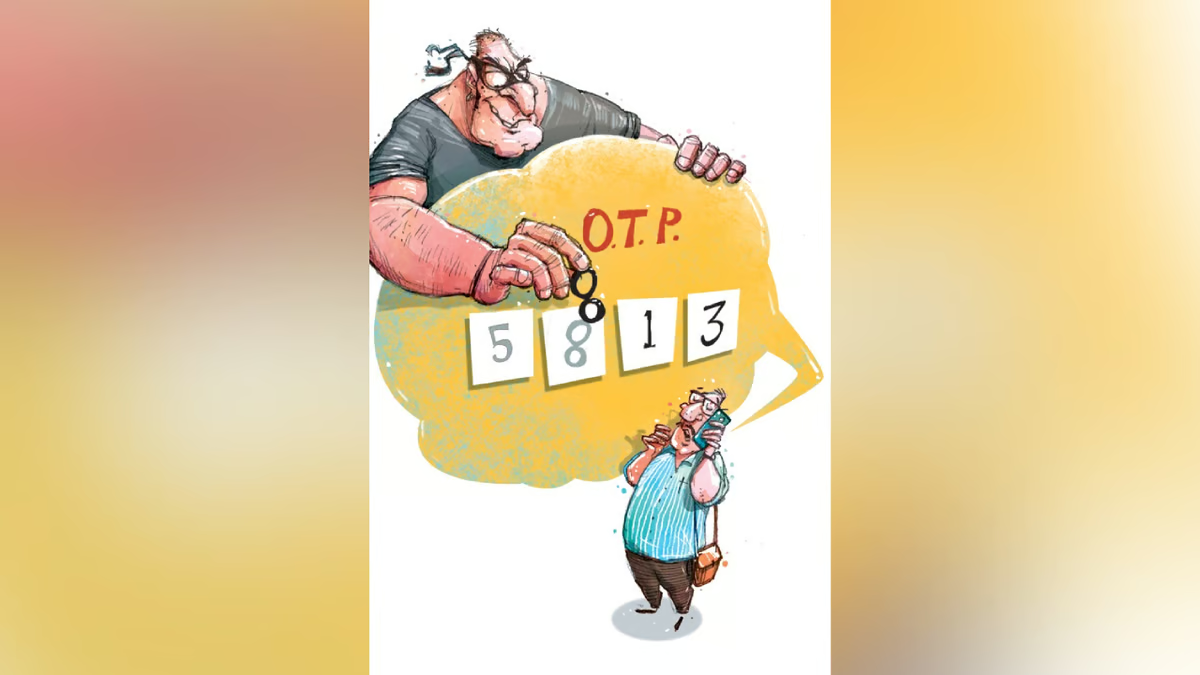

BENGALURU: As more working professionals, taken by greed, are in a rush to earn large amounts of money, the number of stock investment fraud cases is on the rise, especially in Bengaluru. Looking at the alarming rise, the cyber crime police have now formed a special team to probe such cases.

In just four months, Bengalureans lost a whopping Rs 197 crore to fraudulent investment schemes. A total of 735 cases have been registered with zero recovery, while only 10% of bank accounts have been frozen.

In February alone, on an average eight cases were registered every day across different police stations. In the 237 cases registered, people lost Rs 88 crore.

The National Institute of Securities Markets (NISM) has labelled them Ponzi or get-rich-quick schemes that offer unreasonably or impossibly high returns.

Additional Joint Commissioner of Police (Crime) Chandragupta said that even those who know the market and the system are losing money because of their greed for money. “Most of the victims are aged above 30. There are different types of modus operandi in these fraud schemes. As mule accounts are used in almost all the cases, it is difficult to track them. Even if the account holders are tracked, they turn out to be innocent people who were not aware of such transactions,” he said. The police are now holding meetings with bank officials to prevent the use of such mule accounts.

An officer said that in some cases, victims are lured to send money directly to the fraudster’s account. In many other cases, victims receive a link to apps, which are simulation (fake) apps of well-known stock trading apps.

“These fake apps, developed by fraudsters, show that you are making profits. Victims are pushed to invest more money. Rather than withdrawing, victims keep investing their money. Only when they want to pull out their money, do they realise that they were conned. Most of the cases happen over a week or a month,” the officer explained.

He advised people to invest money in genuine apps rather than clicking on any link sent online. They should also not send money to unidentified persons, who offer to double the investment. Victims should contact cyber portal’s 1930 within 24 hours of the scam. If the amount is in a mule account, it can be still be frozen, he added. Nishanth (name changed), a 45-year-old businessman, who lost Rs 2 crore to one such fraudulent scheme, told TNIE he was lured into the scheme by offering huge profits. He said he joined a WhatsApp group where he saw messages saying, “X person made a huge profit in 1 week or 1 month,” “He earned five to seven-digit figures in profit,” and “It’s right to invest in these stocks”.